The Importance of the Financial Sector

The Financial Sector in the Modern Economy

The financial sector is often seen (and in some regards rightfully so) as a haven for an upper class filled with avarice to speculate and gamble their fortunes in order to further bolster their wealth. It is a highly misunderstood sector whose purpose needs to be clarified succinctly. First and foremost, the financial sector is like the metaphorical circulatory system of an economy. It serves several primary functions, including:

- Payment processing

- Risk management

- Intermediation between savers and borrowers

- Liquidity provisioning

These are all critical services that any healthy economy needs, but notably, these are all facilitative goods; that is, the financial sector is a conduit for the efficient allocation of economic resources. Its purpose is not, however, to create final goods. The optimal financial sector is one that is just big enough to enable the adequate facilitation of financial services for the economy to reach maximum productivity.

Why Does It Matter

A financial sector that is oversized can actually be inimical to growth. The ramifications of this aren’t trivial; it makes everyone else poorer so that a few people can have inflated compensation with no productive activity on their part commensurate to the compensation they’re receiving. Furthermore, favorable treatment of the sector by Washington lawmakers creates economic distortions and decreases tax revenue unnecessarily, forcing ordinary Americans who overwhelmingly don’t participate in the financial sector to pay higher taxes to compensate. Economists largely agree that there is a strong case for regulation that stabilizes financial markets and discourages imprudent risk taking.

Ameliorating the Bloat

The only people to face negative ramifications of a downsized financial sector are people who work in the financial sector who receive undue compensation for work that doesn’t justify it. The bottom half of US households never recovered from the great recession and has now been exacerbated by the massive trilemma of the COVID-19 recession’s supply shock, demand shock, and financial shock.

People deserve a stable financial system that doesn’t have a high risk of ruin. This calls for strong, prudent measures to combat financial sector rent-seeking and promote stability.

Banking Stabilization

Leverage, opacity, moral hazard, and other more minor ancillary factors have led to financial intermediaries being unable to make payment obligations, bringing down the whole economy in what is akin to a heart attack. To address these concerns, we have a couple of options:

The first option is the brainchild of Laurence Kotlikoff, who proposes a system where all financial institutions receiving limited liability protection from the government must operate. They may not borrow, and thus cannot fail as they cannot be leveraged at all. There is also a provision that mandates the real time disclosure of all securities held by the mutual funds to address to opacity problem. For those who want more details, there is further elaboration in the Kotlikoff brief.

The second option is the work of Neel Kashkari and other bright minds at the Federal Reserve Bank of Minneapolis who have a 4 point plan as follows:

- Require banks to hold equity equal to 23.5% of risk-weighted assets (leverage ratio of 15% of total assets)

- The US Treasury Department must certify banks to not be a systemic risk or be subject to increased capital requirements up to a cap of 38% or until the Treasury certifies them to no longer be a systemic risk

- A shadow banking tax that taxes borrowing by such entities at a rate of 1.2% (2.2% if designated as systematically important)

- Cutting unnecessary regulation on smaller local banks

It’s somewhat less “radical” than the Limited Banking proposal while still reducing systemic risk substantially. Both remove the complex cruft of Dodd-Frank whilst being far more proactive in dealing with systemic risk.

Reducing Arbitrage and Noise Trading

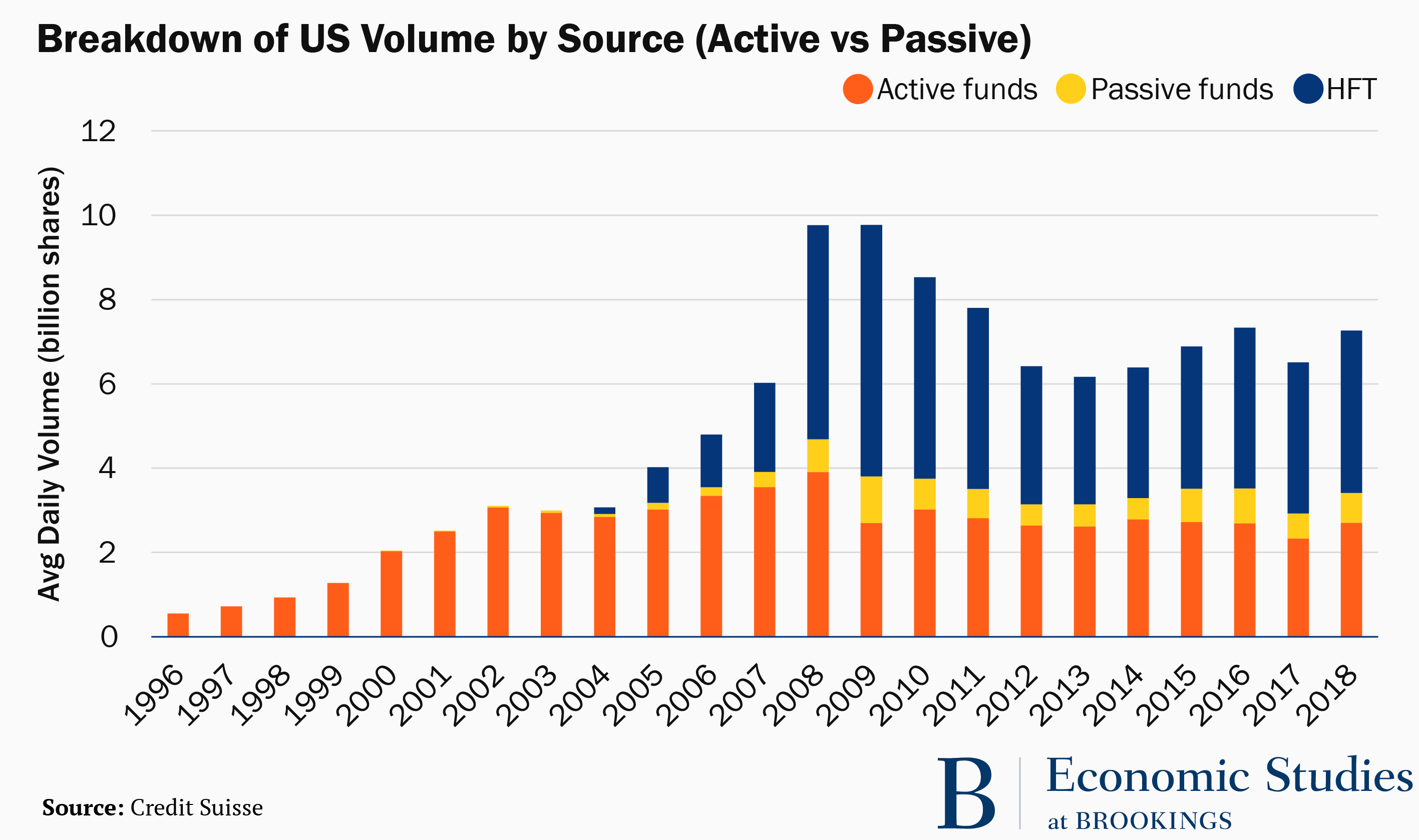

Noise trading is when people make purchasing and sale decisions in a financial market that are solely predicated on an irrational and/or emotional basis. Arbitrage in the context of financial markets is when someone purchases a financial instrument in one market and then profits by immediately selling that asset at a markup in a different market with no risk. These transactions are wasteful and even damaging to an economy. Furthermore, the advent of high frequency trading has made transaction volume explode and global costs to increase, despite the fact that transactions costs are smaller than they’ve ever been.

To address this, a broad based financial transaction tax or FFT could be imposed. It’s worth mentioning that this also acts as a base broadening measure as financial markets in the United States are completely exempt from sales tax. The optimal rate is quite low as we don’t want to discourage productive investments and activity, but it is imperative to reduce the excess to reach general equilibrium in financial markets. The goal is not to raise more revenue, but to make wasteful trading unprofitable. Estimates vary for what the optimal tax looks like, but Eduardo Dávila found that the optimal rate of an FTT is 0.37% given a non-fundamental trading volume of 30%. The literature, however, is inconclusive regarding whether such a tax would decrease or increase volatility. There is also concerns that the large reductions of high frequency trading would impede asset price discovery. Such concerns have been borne out regarding a similar tax on housing market speculation.

Such concerns must be addressed and one such option could be a far more modest FTT of, say, 3 basis points (0.03%) to price out the most frivolous activities. There is also a case for varying rates on different financial assets; stocks being the highest, bonds being lower, and derivatives being the least taxed for example. One such plan could look like a tax of 10 basis points on stocks, 5 on bonds, and 0.5 on derivatives. Regardless, a US FTT would have to have a broad base and minimize distortions as much as possible.

Removing Perverse Tax Incentives

The US tax system is heavily biased in favor of capital and debt. This can be rectified by taking a few steps

- Equalizing dividend taxation with ordinary income and removing its double taxation

- Reforming capital gains taxation by

- Ending stepped-up basis

- Eliminating preferential rates while focusing on reforms that reduce the cost of capital and encourage new productive investment through targeted tax changes

- Enact Auerbach’s interest bearing deferral reform to encourage owners to pay tax during realization of gains

- Ending the tax preferability of debt financing over equity financing

Reigning in Private Equity & Inappropriate Privatization

Public pension funds are nearly always in a contract with a private equity firm as are private non-profit universities. This is where they obtain a great deal of their capital. In many cases, it’s not possible to see what kind of contractual agreements have been setup. Forcing any private equity firm that contracts with a non-profit or public entity to fully disclose the terms of their contract online for all to see would be a great step in allowing the public to give full transparency to how much money they’re skimming off the top.

Private equity firms have also been extremely guilty of purchasing firms in financial troubles, extracting as many assets from them as possible to enrich themselves and their partners, subsequently pushing them to bankruptcy. This is the modus operandi of leveraged buy outs (LBOs). It essentially works by using the profits they get from pension funds and other miscellaneous investors and using that capital for the purposes of acquiring some company. They take advantage of the aforementioned tax preferability of debt over equity and finance their acquisition with borrowed money and then use the companies assets as collateral. The higher the debt-to-equity ratio is, the more their investors profit, incentivizing unstable buyouts that force the acquired company to pay all the interest payments on said debt. The private equity firm can abscond with all their money once the acquired company goes bankrupt and/or is liquidated.

These predatory behaviors are done in lieu of investing the acquired gains into better training, higher wages for workers, capital improvements, real-estate acquisition for expansion, etc. This can thankfully be fixed with some regulation:

- Limits LBOs to no more than six times of earnings before interest, taxes, depreciation, and amortization

- Prevent private equity from mandating acquired companies to pay out dividends to them for 24 months after the LBO

- As said above, all contract stipulations must be made public

- Legally treat private equity firms as owners rather than passive investors to avoid this egregious fiduciary loophole

In the case of everyone else’s retirement, most people now have a 401k (if they’re lucky enough to have an employer that offers one). The fees the financial managers take as a cut can be as much as 1%, which doesn’t sound like a lot, but can easily amount to six figures of lost retirement income. This arrangement makes ordinary Americans demonstrably worst off. Having a public, voluntary retirement plan akin to the Thrift Savings Plan could easily save tens of billions of dollars a year for Americans.

This Demands Attention

The 117th Congress has yielded a Democratic trifecta and would be wise to pass such legislation, but knowing that many of them receive cushy campaign contributions from those in the financial sector, it’s sadly an unlikely proposition. Also note that this is not an entirely conclusive list of things as I left out tangentially related, but broader issues around things such as buybacks and business taxation in a more general view. Increased awareness is necessary and, hopefully, the recent short squeeze introduced to many Americans who were previously rather ignorant about the financial sector the importance of reigning in economic rents and ensuring that the financial sector is solely focused on its core utilities.